DeFi 3+ Whitepaper

The Path To A

New Financial System

There is a fierce battle happening this very moment between the legacy banking system and the innovation that is cryptocurrency decentralized Finance. One side has held unequivocal power for generations and been able to conform the monetary system to suit its needs; the other looks to completely transform the status quo by disrupting this centralized institution.

Content

This article will:

- Define what legacy banking means and how it operates and profits

- Explain the history of the disruptor, Decentralized Finance

- Discuss the logical evolution & future iterations of DeFi by laying out the direct impact it will have on our lives.

Legacy Banking: The Truth About The Middlemen And The Money Printer

The entire legacy banking system is built on a foundation of charging fees and generating interest on money it doesn’t own. A common misconception is that banks make money by accepting deposits and lending it out at a higher rate. What actually happens is much deeper and more one-sided than that. The secret weapon of banks, and what they actually do, is take deposits (customers money) and use that as their reserve requirement to borrow many times that amount from the federal reserve bank. This capital is then used for lending to yield much higher returns, because they leveraged up their lending capacity. This ‘using your money to borrow more money to lend it back to you with interest’ is ALL inflation. Meanwhile, banks offer sub 1% on deposits. This is the power of the legacy banking system.

Adding to this theft, 30-40% of all the U.S. dollars in existence today were printed out of thin air in a 12-month period. If the USD was a cryptocurrency, it might be one of the worse ones. Stablecoins backed by USD may not be so “stable” in the future.

If that weren’t enough, with the “bail in” laws passed by the Obama administration, depositors can have their capital seized if their bank fails. This law puts depositors first in line to cover any insolvencies of a failed bank.

Many see it as unfair and dishonest to have to pay for a bank's risk taking while receiving zero benefit from this endless inflation of fiat currency that is printed out of thin air.

Early warning signs of this battle have become evident in that yields in cryptocurrency are quickly eroding at the asset base (reserves used to borrow from the Fed) of traditional banks. Consumers are moving to much higher yielding cryptocurrency staking to earn transaction fees in liquidity pools and rewards/interest for staking cryptocurrency.

Decentralized finance: Enter The Disruptor.

Decentralized finance, or DeFi, defined by investopedia: A system by which financial products become available on a public decentralized blockchain network. That makes them open to anyone to use, rather than going through middlemen like banks or brokerages. Unlike a bank or brokerage account, a government-issued ID, Social Security number, or proof of address are not necessary to use DeFi. More specifically, DeFi refers to a system by which software written on blockchains makes it possible for buyers, sellers, lenders, and borrowers to interact peer to peer or with a strictly software-based middleman rather than a company or institution facilitating a transaction.

We will now look at the progression of DeFi.

Pre-DeFi

The setup for DeFi flourishing was enabled by Ethereum's ability to ‘program money’ using their smart contract platform. For the first time, anyone could create a digital currency for any use they liked. This movement became its own fundraising event for new blockchain protocols called Initial Coin Offerings (ICO’s). To create buzz around a project, airdrops or free tokens were given to build communities.

Pre-DeFi created the term tokenomics (token economy), which is the creation of self-sustainable mini digital economies. Through the study of tokenomics, we are able to see game theory in action and how players in a system behave. There are now countless token economies in existence today that provide proof of what works and what does not.

DeFi 1.0: DeFi Summer 2020

During the summer of 2020, decentralized finance began the initial replacement of the legacy banking system. There were multiple things in place that created a major inflection point for cryptocurrency and DeFI:

Browser Wallets like Metamask made it very easy to create wallets and interact directly with blockchain applications.

Decentralized Exchanges came into prominence with UniSwap giving users the ability to swap tokens anonymously without the verification steps centralized exchanges require.

Stablecoins allowed you to stay in cryptocurrency and not have to exchange in and out of fiat when you were entering or exiting trades. They also maintained your value until your next trade. During DeFi summer, stablecoins like DAI from MakerDao allowed for leverage for cryptocurrency traders.

Stablecoin Evolution: 3 Types

- Centralized and Physically Asset-Backed

- Stablecoins like Tether and Paxos Gold physically back their cryptocurrency with USD and physical gold, respectively. You buy these on the open market or supply the physical collateral/USD for these protocols to “mint” new stablecoin. This is a way to preserve your value. However, centralized systems require faith that 1 Tether actually is 1 USD when you redeem. Tether has come under scrutiny with claims that there is not actually a 1:1 Tether/USD ratio. Furthermore, systems like this are easily shut down by banks or regulators. Physically asset-backed stablecoins provide an attractive alternative to invest in the cryptocurrency market, while giving you exposure to another asset like gold.

- Crypto-Collateralized

- The stablecoin market, then, evolved to take a step to further decentralization. Stablecoins like MakeDAO use ETH-based cryptocurrencies as collateral to mint their stablecoin. With systems like this, you are not relying on a centralized authority or entity to “back” the stablecoin. It is only you pledging the collateral to a smart contract which is public proof that it exists as collateral on the blockchain. This gives you certainty that the system truly has underlying value that can’t be taken away or falsified (like the Tether accusations). However, in times of market volatility, your collateral can be liquidated if the “loan to value” ratio breaks a threshold.

- Algorithmic

- Purely algorithmic stablecoins rely on market forces and smart contract software rules to maintain the price of the dollar or whatever asset they are tracking. Terra Luna is a 2-token system (utility token and stablecoin) that allows you to burn one of the tokens to mint the other in times of stablecoin price instability. For example, if the price of TerraUSD is above the dollar, you can burn the utility token for TerraUSD at the exchange rate at the price it should be. Then, you can sell for a profit helping to bring the price back down of 1 TerraUSD equal to 1 USD. Incentivizing the market keeps the stablecoin at the price it should be. Purely algorithmic stablecoins have no underlying collateral. If market forces fail or there are issues with the software code, there is no recourse to get your money back.

Leverage in DeFi is done from minting a stablecoin, then using the stablecoin to buy more collateral to mint more stablecoin. When the ETH price collapses, collateral that was used to mint DAI, many are automatically liquidated out of their position.

Staking involves locking up your cryptocurrency to earn interest or rewards. The most well-known staking is in proof of stake blockchain protocols where you earn part of the transaction fees of the network. You could also stake in a decentralized lending platform like AAVE to earn interest or stake in a liquidity pool in a decentralized exchange like UniSwap. In UniSwap, you earn transaction fees for providing liquidity to traders of that decentralized exchange.

Yield Farming is staking or lending crypto assets in order to generate higher returns or rewards in the form of additional cryptocurrency. Typically, new protocols would give you more of their tokens for staking in their liquidity pools in addition to the transaction fees you would earn. This made returns soar.

DeFi 2.0: Flood Of Innovation

I spent some time looking for a universally accepted definition for DeFi 2.0. There was no clear description. What is clear however is there is massive innovation happening at a speed which has never been seen in technology. It takes hours a day of study to keep up with everything that is happening. I call DeFi 2.0 the “Flood Of Innovation” which is helping blockchain entrepreneurs to experiment incredibly fast. With the open-source nature of blockchain, learning what is working economically and being able to leverage existing code is causing the speed and flood of innovation. It is DeFi 2.0 that is setting the stage for DeFi 3.0+ and a clear path to this new financial system.

We will discuss the areas setting up DeFi 3.0+.

With much development on ETH causing higher gas fees, other protocols are competing to offer faster and lower cost smart contract platforms. Binance, Avalanche, Solana and PulseChain are a few. However, ETH remains the dominant platform with 65% or so of the DeFi market.

Other protocols like Cosmos are helping to bring about blockchain interoperability & cross-chain liquidity. They allow you to move one token on a blockchain to another joining these ledgers. One method this is being done with is bridges where the token is locked on the native blockchain you are leaving and a “wrapped” version of the token, which mimics the native token price, is minted on the blockchain you transfer in to.

Scalability has become a big issue on Ethereum while the protocol looks towards solving that with scharding (splitting the database) and using a proof of stake consensus algorithm. Layer 2 solutions like Polygon create a “side chain” to perform transactions to post/verify transactions on the ETH mainnet. Decentralized Oracles provide a way for blockchain applications to get pricing they need to operate without the worry of the price feed being shut down or being wrong. Chain Link seems to be the dominant player in this area.

Up until recently, projects needing to bootstrap liquidity would give rewards in the form of their token to liquidity providers. This “renting of liquidity” is not sustainable because liquidity providers run to the next higher yielding project crashing the project they just left. Protocols like OlympusDAO and Tokemak are solving this by incentivizing liquidity providers with token rewards where the protocol owns the liquidity (POL: Protocol Owned Liquidity). This economic and technological direction will lead to a “Liquidity Singularity”, combined with blockchain interoperability, where you will be able to swap from any token on any blockchain to another easily.

NFT’s are putting a period at the end of the DeFi 2.0 transformation. Non-fungible tokens are one-of-a-kind tokens that represent the unique ownership of a digital asset. NFT’s by well-known artists are selling for outrageous amounts in the 10’s of millions. Welcome to the world of the million-dollar JPEG’s!

The Future Of DeFi And How It Will Affect Us

DeFi 3.0: Infrastructure For Mass Adoption

We are still in the problem of mass consumer adoption and real business use cases for cryptocurrency. There are 3 elements that need to be in place to have mass adoption in cryptocurrency and make up DeFi 3.0.

Stablecoins are the holy grail because they hold the key to mass adoption of cryptocurrency. People won’t trust a stablecoin to preserve their value unless it preserves their value and can’t be shut down or taken away. The everyday person will not get their paycheck in a stablecoin unless they know what they earned will be there. There is a battle of the stablecoins happening not only within DeFi but governments trying to compete with their centralized and highly controlled Central Bank Digital Currencies concepts. Governments are looking to regulate stablecoins because they cannot compete with the free market. Governments and Central Banks have a different agenda following the ESG public policy nonsense (guiding investments around Environmental, Social and Governance.).

A Regulation Target

Let’s face it. Regulation of crypto is all about trying to maintain control and the threat to the US Dollar world reserve currency status. The US government would lose the ability to print money out of thin air for political control and to loan/donate to countries for “favors” and decisions that could potentially benefit the US.

Crypto makes it more difficult to track transactions and people. This is not acceptable to the US government. Biden recently began tracking all USD bank accounts with more than $600, a complete violation of the 4th amendment and many other things.

The “infrastructure bill” has provisions where everyone in crypto is a broker and subject to KYC compliance. How can a blockchain developer track who is using software that has been released to the world and has a life of its own (the nature of decentralization)?

Stablecoins are the target because they remove the need to go back into fiat, where KYC and tracking can occur. Stablecoins are also widely used. SEC Chairman Gensler said “that roughly 75% of all crypto trades involve some kind of stablecoin”.

For the first time in history, we have a technology that has the potential to change the relationship between man and government. This change is in favor of the individual so governments are fighting it.

Effects of Regulation Overreach

- Inovation moves to countries that embrace the change. If the USA regulations go too far, it will cripple the chances of continued financial dominance and move it to other countries. The economic impact of the convergence of a multitude of technological platforms is going to have a 20X+ the impact of the Internet. (Blockchain, Artificial Intelligence, Robotics, Energy Storage and Genome Sequencing) No country can afford to push innovation in these areas to other countries.

- Blockchain protocol creators go dark and release anonymous projects.

- Blockchain systems will move further to decentralization and be impossible to be captured.

What does decentralized finance mean in this context?

Since a stablecoin is a cryptocurrency in the government’s crosshairs, decentralization is crucial. It means that every aspect of the protocol cannot be influenced, seized or shut down by any government, bank or organization. Every part of a DeFi protocol needs to be capture proof. This makes it a safer choice for many people who want to keep their money safe from governmental interference and manipulation.

The process of decentralization

This is not easy, but it can be achieved by using distributed ledger technology. This is the technology that is used to record transaction history and information on many computers or “nodes” at once. When all nodes are updated with the same information, this data cannot be changed or falsified.

This allows for a DeFi stablecoin to be fully transparent, unchangeable and accessible to all users. As you can imagine, this will be an excellent choice for anyone who wants to keep their money safe but also remain anonymous.

Despite the progress in defi, a vast majority if not all blockchain dApps (decentralized apps) are not fully decentralized. Website servers, domains and server access to blockchains, like Infura for ETH blockchain access, are still centralized and can be captured. Case in point is when UniSwap delisted all stablecoins from its “decentralized exchange” front end at the potential threat of the SEC regulating stablecoins and investigating UniSwap. Liquidity pools for these stablecoins plummeted even though they are decentralized on the blockchain. The front-end access is not.

Protocols like the Internet Computer and Cartesi have solutions to decentralize front servers and cloud computing. However, the crypto industry has yet to take the final step.

A regulation proof Stablecoin

To be truly decentralized, a regulation proof stablecoin needs to be both crypto-collateralized and algorithmic. It cannot have any single entity in the process like what we see in all of the physical asset or USD-backed centralized systems. Having the stablecoin backed by other cryptocurrencies gives faith in the system that there is underlying value that can be redeemed at any time without centralization. Also, it must be algorithmic to provide further price stability. This is the best possible combination of stablecoin capabilities that exists in the market.

Philosophically, the creation of currency should be decentralized rather than a single entity controlling the money supply for a nation. Since the best currencies have an underlying asset, the collateral owner should be the one earning the interest.

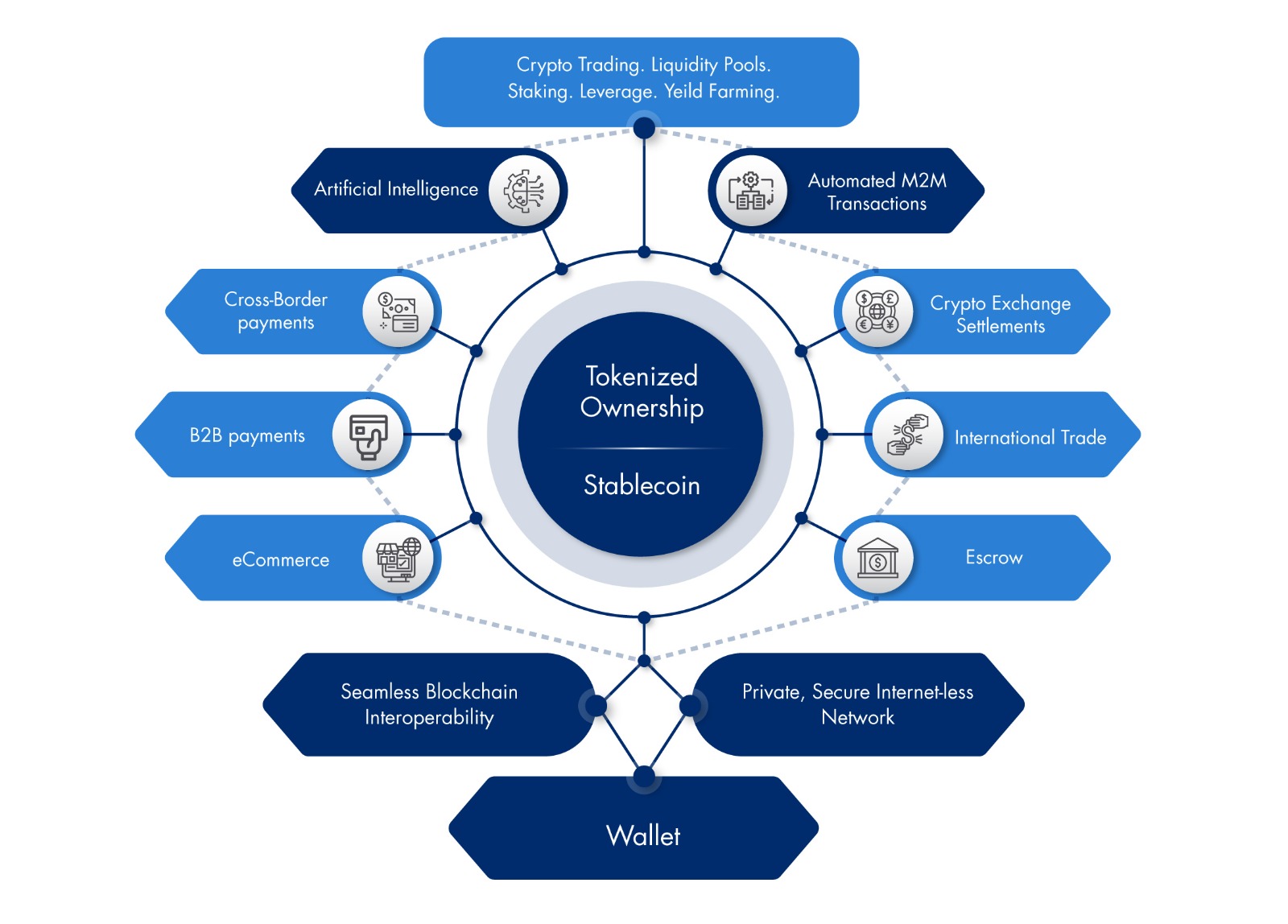

dApps (Decentralized Apps) with the right use cases will drive the usage of the stablecoin replacing legacy banking.

Crypto Credit Card

This is an important application as it allows the crypto community to spend crypto in the legacy payment system (point of sale and online) where the card holder pays in crypto but the merchant receives fiat currency.

B2B Payments

This $23 trillion per year market is an excellent use case of a stablecoin to make fast, bankless business-to-business payments to trusted vendors much less expensively. As more companies begin to transition to crypto in their corporate treasury, a stablecoin payment will be the natural progression. The blockchain gives an easy way for businesses to automatically account for payments and financial reporting.

Cross Border Payments

The consumer version of B2B payments is sending money to anyone in the world, anytime with little cost. This is nearly a $40 trillion per year market.

eCommerce

Online purchases are a $4 trillion per year market. This doesn’t necessarily need to be its own decentralized application but could be a browser extension taking over the shopping cart allowing the purchaser to spend crypto and settling in fiat to the merchant.

Escrow

Using the blockchain and a stablecoin, escrow services would cease to have middlemen and escrow agents for things like real estate transactions, stock and company acquisitions and automobile purchases.

International Physical Commodity Trading

Another escrow type transaction, a $16 trillion per year market, would be to use the blockchain for the purchase of physical commodities from one country to another. These transactions take too much time, have unneeded middlemen and tremendous fraud. Banks also charge high fees to handle the payments for these transactions in the form of Letters of Credit and Standby Letters of Credit. An example of an application like this could remove as much as 15% of the cost and dramatically lower the process time using the blockchain:

Swift Replacement

Banks communicate with each other and transfer capital using the SWIFT system. The Society for Worldwide Interbank Financial Telecommunication was created in 1973. It is time for something better, a messaging service for crypto transactions where the counterparties communicate directly with each other. Each identity, KYC (Know Your Client) and proof of funds is proven by the blockchain. The messaging is verified, encrypted and secured on the blockchain. This makes larger transactions truly sovereign.

NFT’s will evolve to where they represent tokenized ownership of real-world assets like real estate and cars, etc. One blockchain project tokenized the ownership of a resort and sold fractionalized ownership. Imagine a NFT representing your fractional ownership of an apartment building. Net rental income is paid to you in crypto every month. NFT’s will also represent digital ownership of financial instruments like stocks and bonds.

I envision a cryptocurrency that would allow you to mint a stablecoin using a NFT. In fact, we are building this type of stablecoin with this capability.

www.BankX.io. is the first cryptocurrency to pay you interest for minting a stablecoin. Version 2 of the system will allow you to stake a NFT to mint the stablecoin. You can see with a system like this that traditional collateralized loans become useless. Why pay interest to a lender when you can use your collateral to not only create a currency but also to earn interest.

DeFi 4.0: Onramp

In the future, everything you do will involve a private key. It will not only be your crypto wallet but your identity, KYC information, access to your sensitive documents, how you send secure financial messages, interaction with all dApps and hold and control your tokenized ownership of physical and digital assets. This transformation cannot be understated. It will have a 10X+ impact larger than the innovation around the Internet.

If stablecoins, dApps and NFT’s are the key to mass adoption, the wallet is the onramp to this new financial system. Cathie Wood of Ark Invest said, “We see the wallet market as a winner take all scenario.” This statement stuck with me because I agree with her and have thought this for some time. However, the solution is not just an “easy to use” mobile app although that will help

Crypto wallets have these categories:

- Self-custody where you own and control the private keys and seed phrase. Crypto enthusiasts say “Not your keys, not your crypto.”. This is a great way to keep your keys but if you lose the private key, the seed phrase or someone else gets access, you could lose your crypto.

- Multi-Sig wallets give a layer of protection since 2 or more people need to sign the transaction before the crypto is sent. However, you need a consensus with the wallet holders before a transaction where disputes could prevent this from happening.

- Third-Party custody services like Galaxy Digital store your keys in their vaults. Institutions usually opt for this solution but you are relying on someone else for the security of your keys. Fireblocks recently “lost” the keys to $70M in ETH. This ‘relying on others’ to secure your keys is the same issue you have with keeping your crypto in centralized exchanges.

As the Internet collapses into Distributed Ledger Technology, the crypto community needs its own network. This will be a separate, Internet-less, overlay network that will store the private keys for everything you do in this new financial system. This network will provide “Decentralized Custody” of your keys in the most secure network initially in servers in vaults, then in satellites. The move to a satellite network will prohibit any physical access to the actual storage devices. Not only will this system be incredibly easy to use but you will never be connected to the Internet but you will always be connected to your keys. Decentralized custody brings the best elements of the types of private key custody that are available in the market today but also give you the advantages of both a hot and cold wallet (hot is connected to the Internet and the cold wallet is not).

This decentralized custody network will evolve solutions that were offered in previous DeFi iterations. Blockchain interoperability will be achieved through this decentralized custody network and users will not have to rely on protocols like Cosmos bridging between chains. Interoperability happens at the network and wallet level. This will allow dApps and blockchain protocols to operate on all or multiple chains giving the general dApp system further decentralization. Different blockchains have different advantages and disadvantages. By running natively on these chains, the market and the specific user chooses what is best for them. You can move between any crypto to any crypto in this overlay network. This network also provides a certain element of privacy as you move from one blockchain to another using this decentralized custody overlay network. An example of this is using the Exodus wallet to swap from one crypto on one blockchain to another crypto on a different blockchain. This is expensive to do. In the future, this will be seamless and free .

We are building this exact solution at www.LockBox.io.

DeFi 3.0 and 4.0 are enormous infection points for the crypto movement

DeFi 5.0: Artificial Intelligence And The Blockchain

AI is a generic term that is thrown around and applications using it are often mislabeled. To see the impact of artificial intelligence, it is important to understand the differences in the technology.

Machine Learning vs. Deep Learning vs. Artificial Intelligence

Here are examples of how the Blockchain and AI will work together in DeFi 5.0

- Blockchain verifies the data sources and their authenticity. AI uses the blockchain for data integrity before it is sent to the AI algorithm proving what data is trustable. The blockchain also verifies the AI algorithm itself and that it was from the intended author via blockchain identity verification.

- AI scans the blockchain for transaction fraud of all types.

- AI scans for blockchain operational efficiency

- Track counterparty blockchain identity and KYC for fraud.

- Learns counterparty behavior and transactions in DeFi to find fraud and other criminal behavior.

- Anticipates security threats

- AI on mobile devices analyzes typing and swiping behavior on the touchscreen to make sure it is the user. (Signature, Gestures and Typing)

- Blockchain is version control and gives the ability to unwind the advancement of the algorithm as the deep learning algorithms evolve. This would ensure the dystopian future doesn’t occur.

- Blockchain will allow the sharing of threat intelligence, authentication of digital identities in those that use the shared intelligence.

- There will be a platform where financial security companies can share data, models and/or insights to better protect against fraud using the blockchain allowing for this type of "Swarm Intelligence". The end user controls what data is shared. AI models can be traded between security companies. Each security company builds and trains the model with their local data for a specific purpose. I envision a market of algorithms, different weights and biases for specific purposes that can be automatically traded and verified on the blockchain.

- AI for intelligence gathering, generation of real-time threat alerts, draw correlations between related threat data and improve analysis of existing and emerging threats.

DeFi 6.0: Automated Machine-2-Machine Transactions

The last step in the replacement of the legacy banking and financial system is where transactions are automated. The blockchain is verifying identity, data, AI algorithms, etc. AI is kept friendly using the blockchain. AI models progress to the point where the entire supply chain is automated and working flawlessly. The exact product, amount and delivery time is exactly what you need just as you need it. Machines are communicating with each other constantly monitoring behavior and preferences of every human on earth delivering what they need exactly when they need it, the equivalent of the economic invisible hand in digital, blockchain, AI form.

The battle of legacy banking vs DeFi pits a dinosaur with slow to change aspects, drowning in a sea of overhead and regulation against a young, lean, quickly iterative new entrant to the marketplace.

Conclusion

One of two financial systems is going to prevail over the next decade, a new decentralized one designed to benefit the people or a digital version of the centralized, corrupt legacy banking system we have today. This whitepaper outlines the steps of the former. For this to happen, cryptocurrency needs mass adoption. Mass adoption is going to need the right stablecoin with decentralized apps that are better, faster and less expensive to transact than the current systems in place. With the setup for mass adoption, an onramp with the right cryptocurrency wallet is needed. This will be a private network which decentralizes the custody of your private keys and cryptocurrency wallets as the best solution. Decentralized custody is superior to self-custody or 3rd party custody because no one else has digital or physical access to your keys and they can’t be lost. You are always connected but never connected to the Internet (where most of the hacks occur). This paves the way for artificial intelligence and automation in this new decentralized financial system.