Whitepaper

Content

Abstract

BankX brings a dual token, partially collateralized, partially algorithmic stablecoin to decentralized finance. The stablecoin is the first to pay you interest for minting while it is in circulation while never being at risk of liquidation. It has many attributes of the legacy centralized banking system but is designed to benefit the individual. The protocol includes a way to lock up tokens to earn more tokens. It also employs a “Protocol Owned Liquidity” model.

Background of the Central Reserve Bank and the U.S. Dollar

The Federal Reserve Bank was created in 1913 and is privately owned with a presidentially appointed board of governors. In 1944, delegates from 44 Allied countries met in Bretton Wood, New Hampshire, to come up with a system to manage foreign exchange that would not put any country at a disadvantage. It was decided that the world’s currencies couldn’t be linked to gold, but could be linked to the U.S. dollar, which was linked to gold. In 1971, the U.S. removed the gold standard allowing the privately held central bank to print currency out of thin air and charge interest. The U.S. maintains the demand for dollars by forcing its use in global trade and denominating debt in USD.

Problems

With large price swings in most cryptocurrencies, traders needed a way to stay in crypto to avoid going in and out of fiat currency. It was a natural progression to have a USD cryptocurrency. These USD-backed cryptocurrencies keep dollars in a physical bank, typically 1:1. This is a chokepoint where the stablecoin system could be captured or shut down by the bank or regulators. You are also relying on a central 3rd party to keep the exact ratio of dollars in the bank vs. crypto dollars in circulation. Tether, an alleged 1:1 USD to crypto stablecoin, has come under scrutiny for not having the correct amount of USD in reserve vs the amount of tether in circulation. There are allegations that Tether is minting Tether to incentivize the onboarding of customers to cryptocurrency exchanges.

This inflating of the Tether supply, with no USD backing, has also been linked to the run up in the Bitcoin price. It could be a coincidence but the suspicion of Tether remains. It has also been reported that USDC generates $1.6B in revenue per year using your money.

30-40% of all the U.S. Dollars in existence today were printed out of thin air in a 12-month period. With that kind of inflation and no plan to counteract it, holders of USD suffer tremendous loss in value. If it were a cryptocurrency, it would be one of the worst ones. This is not the best choice for the price peg of a stablecoin.

Evolution of Stablecoins

The stablecoin market took a next step in innovation where systems like MakerDao required other cryptocurrency as collateral to back their stablecoin. This removed the need to hold dollars in a bank and eliminated the suspicion of 1 dollar to 1 stablecoin in the Tether case. However, big price swings in the underlying collateral can cause liquidation events.

We, then, saw purely algorithmic stablecoins that use market forces to maintain the price peg. Simply, if the price of the stablecoin is below the dollar, the market is incentivized to buy it bringing the price back to the peg. Profit is also made by selling when the price is above the peg. Purely algorithmic stablecoins have the issue of no collateral in the case where market forces fail.

Current Solutions:

Terra Luna is a dual-token algorithmic stablecoin. It maintains the peg of USD by allowing for arbitrage opportunities between the two tokens. If the price is above the peg, you can burn the utility token for the stablecoin and sell it for a profit. Below the peg, you do the reverse.

Terra Luna lost its peg and failed because the market decided not to keep the peg. Holders of the stablecoin had no where to go to retrieve their underlying value. Terra Luna’s price stabilization mechanisms work most of the time in most situations. However, a stablecoin with no collateral has a high probability of failing. See “Arbitrage” below on the BankX improvements to this price stabilization mechanism (in addition to having collateral backing XSD).

RAI/Reflexor Labs is another algorithmic stablecoin where its price follows Ethereum. The difference is this protocol uses a software controller to remove the big price moves in ETH. RAI is 100% dependent on ETH and has no collateral backing the stablecoin.

Frax was the first to fractionally collateralize a stablecoin and to also be partially algorithmic. The system has 2 tokens, one utility and one stable pegged to the price of USD. The market determines the amount of collateral backing the stablecoin and allows for opportunities to profit which maintain the USD peg. The only use of the utility token is partial collateral to mint the stablecoin and to pay fees in the system.

Game Theory and Market Proof:

A healthy tokenomics strategy is crucial for the launch of any cryptocurrency. Getting the game theory aspects of an economic system correct is needed to maintain it. We have analyzed numerous projects and have chosen the best aspects of each. Then, we added unique capabilities, like earning interest for minting a stablecoin, to advance the protocol.

USD-backed cryptocurrencies, like Tether, Paxos, etc. were not considered. These systems are not a sustainable solution because they can be shutdown.

Terra Luna has been very successful in maintaining the USD peg so we used the market forces concepts they employ (no collateral was the cause for failure). By minting and burning between the 2 tokens adjusting the supply of the stablecoin, the system helps keep the price at the peg. This has longevity because the crypto community earns profit anytime there is an imbalance. The problem is there needs to be collateral to give confidence in the system and allow users to be able to redeem something of value should market forces fail.

Frax is both algorithmic and partially collateralized. Market forces determine the percentage collateral with a utility token added to get 100% collateralization. For instance, if the collateral percentage is 85%, then that would be $85 of ETH and $15 of their utility token to mint $100 of their stablecoin. This concept helps to also maintain the price peg. If the price of the stablecoin is above the peg, the system will lower the collateral percentage of ETH which allows more people to mint, increasing the supply and lowering the price. If the price of the stablecoin is below the peg, the system will increase the collateral percentage of ETH restricting the minting of the stablecoin, decreasing the supply and raising the price. If the price of the underlying collateral, ETH, changes, there are incentives in the system to add more collateral when there is a collateral deficit and to distribute value to the utility token holders when there is a collateral surplus.

Our Solution:

BankX is the first cryptocurrency to pay you interest for minting a stablecoin. You earn interest the entire time that it is in circulation. Interest is paid to you when you pay back the stablecoin to the system redeeming your collateral.We have taken the Frax protocol and added the Terra Luna dual token, minting/burning capabilities. We have pegged the stablecoin to the price of one gram of silver. For reasons above, pegging to any fiat currency is not wise. We also do not use any fiat-backed crypto as collateral to mint the stablecoin.

In addition, we have a compelling utility token lockup opportunity.

Dual Token Silver-Pegged Stablecoin

The BANKX Token can be locked up to earn more BankX tokens and is also used as partial collateral to mint the BankX Silver Dollar (XSD).

BankX Silver Dollar (XSD) is collateralized with ETH and BankX Tokens. Market forces provide price matching to silver. The BankX Silver Dollar is designed to mimic the price of 1 gram of silver.

BankX Token Lockup Rewards

The BankX Token Lockup Rewards allows you to earn more BankX for locking up your BankX tokens. The longer you lockup, the more BankX you earn. Central Banks inflate currencies to distribute fiat currency however they like. Bitcoin inflates its cryptocurrency each block in order to pay miners in the network. BankX inflates the supply of BankX Tokens to pay you rewards for locking up your BankX Tokens. This economic strategy incentivizes the locking up/holding of BankX Tokens, reducing the supply. The token supply reduction from locking up far outpaces the inflation used to pay the token lockup rewards.

Earning Interest When XSD You Mint Is In Circulation

With the above ‘locking up of the utility token to earn interest’ in mind, it occurred to us that since you are essentially locking up BankX Tokens to mint XSD, why shouldn’t that minter of the stablecoin get more BankX tokens for doing so? Out of that was born the idea: BankX is the first stablecoin to pay you rewards in the form of the BankX token on the XSD you have minted while it is in circulation. When you pay back the XSD to redeem your collateral in the system, the rewards due is paid in the form of BankX Tokens.

Inflation and Locking Up

In its most basic form, the locking up of BankX Tokens in the Token Lockup Rewards and the “locking up” of BankX Tokens needed to mint XSD far outpaces the inflating of the token supply used to pay rewards. Inflation never catches up to the amount locked up.

How It Works

All functions within the BankX system are accessible through our web application with a connected browser wallet at www.BankX.io. (MetaMask)

What you can do with BankX

- Mint XSD and earn interest:

Lockup ETH and the BankX Token to mint the XSD stablecoin. From the time you mint, while XSD is in circulation, you will earn interest in the form of more BankX Tokens. When you pay back XSD to redeem your collateral, you will be paid the interest due.

- Looping:

When you mint XSD, you can then use that same XSD to buy more ETH and BankX to mint more XSD earning even more interest. You can do this as many times as you like multiplying the interest you earn. This capability will be automated on the BankX website.

- Lockup BankX Tokens to earn more BankX tokens

Use Token Lockup Rewards to lockup your BankX tokens to earn more BankX.

- Neutral position for crypto trading:

Trade in to the XSD stablecoin when not in other cryptocurrencies to avoid being in fiat currency. Since the XSD stablecoin is pegged to the price of 1 gram of silver, you also have an inflationary hedge.

- Profit by stabilizing the price of XSD:

We have designed the BankX system so that the community can profit by keeping the price of XSD at the price of 1 gram of Silver.

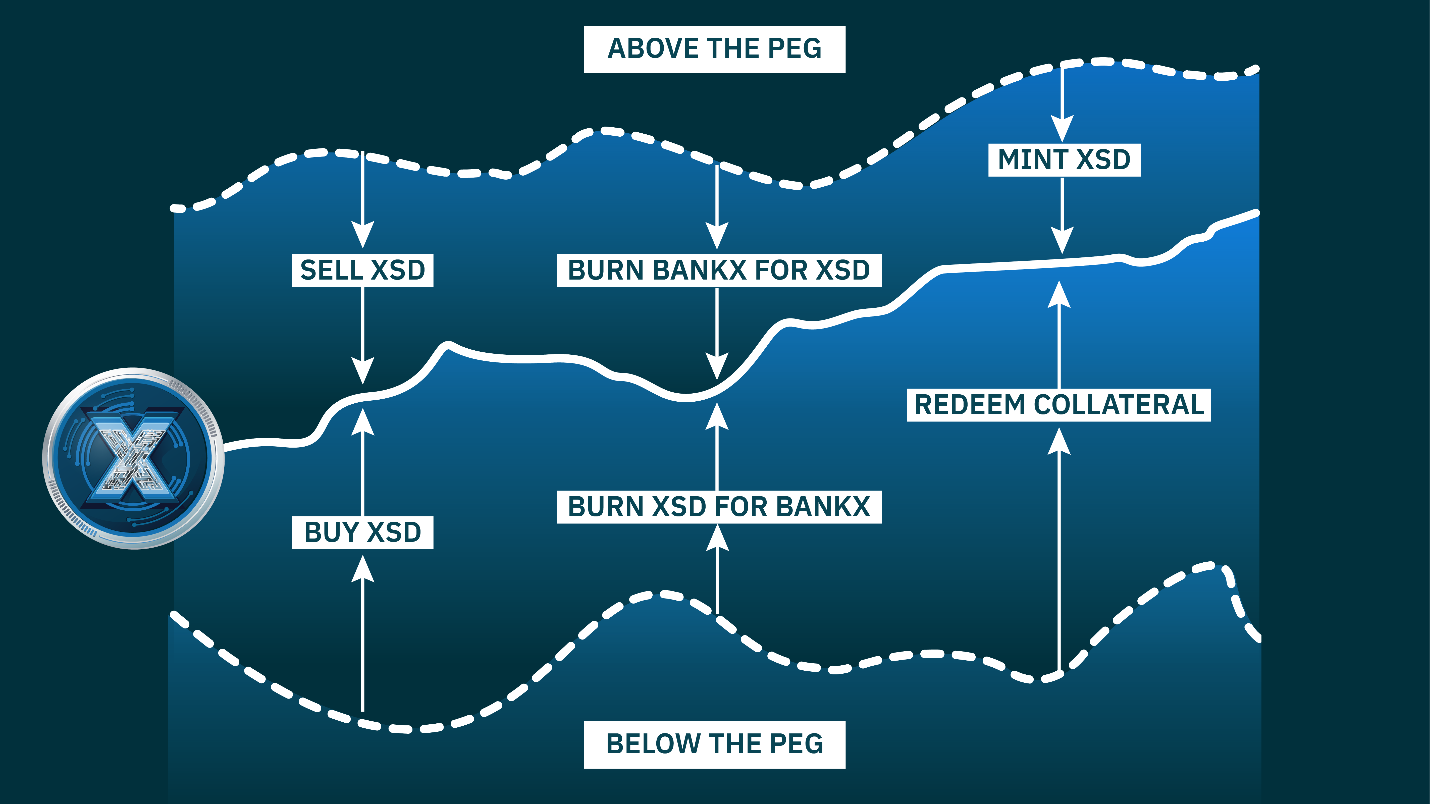

XSD price is ABOVE the peg

Sell XSD

Burn BankX for XSD

Mint XSD and sell it

XSD price is BELOW the peg

Buy XSD

Burn XSD for BankX

Redeem your collateral

Arbitrage

The concept of burning one token to mint the other in this dual token stablecoin system has been improved upon from other methods. Since the BankX system owns and controls the liquidity pool for both BankX and the XSD stablecoin, 1 operation can complete an arbitrage opportunity that returns more tokens to the user while helping to keep the price of the XSD stablecoin at the peg of 1 gram of silver.

Example:

1 gram of Silver = $1

XSD = .80 cents

BankX = .10 cents

XSD is “below the peg” where the arbitrage opportunity exists to burn XSD at the price it should be for BankX. In 1 operation in the smart contract:

- User starts with 1 XSD

- Burn 1 XSD for 10 BankX

- Sell 10 BankX for $1 in ETH

- $1 in ETH buys 1.25 XSD

Result: User increased their XSD from 1 to 1.25 while helping to increase the price of XSD towards the peg.

The opposite would happen if the price of XSD was above the peg. The user would gain more BankX tokens while helping to provide sell pressure to the XSD liquidity pool.

To maintain efficiency of the exact number of XSD need to buy or sell in our liquidity pool to achieve the peg of 1 gram of silver, we have developed the following equations.

The XSD liquidity pool is a constant product liquidity pool governed by the equationwhere x is the total value of XSD token in the pool and y is the total value of ETH token in the pool. Then, we may express the constant product equation as

where n_1 and p_1 are the number of XSD in the pool and the price of one XSD. Likewise, n_2 and p_2would be the number of ETH in the pool and the price of ETH. Then, we may express the total number of XSD for a given price p_1 as

Then, the number of XSD needed to have p_1 be the price of silver s_p, denoted by "tar".n_1, is

This implies that the number Δn_1 of XSD that need to be added or removed from the liquidity pool to ensure the price is given by

where "init".n_1 is the initial amount of XSD in the liquidity pool.

Why Now?

Using other stablecoins like Paxos, we didn’t like the centralized chokepoint that could shut down the currency we were going to use. Secondly, we are building other blockchain applications that will need to use a stablecoin so why give that market to a solution we didn’t like. That was the start of architecting our own stablecoin. Some had great characteristics and proved many things about how a stablecoin could work. However, no stablecoin in the market had all the capabilities that BankX required.

The USD is heading for trouble and we think we have a better alternative as a cryptocurrency. With worries of inflation, now is the best time to launch this type of stablecoin. At the time of the writing of this whitepaper, there is approximately $2T in cryptocurrency, around 10% of the global GDP. As the system tips with more early adopters, we are in a great position with a solution that no one else has.

Decentralization

Once the enhancements and upgrades to the system are done, the keys to the smart contract will be destroyed. We will also decentralize the front end website and application using a blockchain domain and multiple installs of the front end by the community. We are designing this system so that it can never be captured.

Protocol Owned Liquidity

Typically, a new project rewards liquidity providers with more of their tokens to increase the returns beyond the transaction fees you would earn in decentralized exchanges. This concept is called “renting liquidity”. Then, someone would clone the project, increase the number of tokens given pulling the liquidity to the cloned project. This crashed the original project.

Projects like Olympus DAO (and countless clones) have solved this liquidity problem by restructuring the incentives so that the protocol owns the liquidity. High yield seekers cannot run off with liquidity at the next higher returns project. Essentially, you get a bonus in tokens on a vesting schedule for selling in to the liquidity pool. This liquidity is then owned by the protocol. It is similar to a bond and called POL’s (Protocol Owned Liquidity).

BankX has a similar system where the protocol owns the liquidity that increases over time by offering a bonus in BankX tokens for adding collateral to our liquidity pools. BankX minters and people who lockup BankX can be assured that there will be a market for BankX tokens and XSD.

We will discuss this more later.

Minting The Stablecoin Earns Interest:

Blockchain Data Storage and Calculation

We looked at numerous solutions over several months that would be able to efficiently store the stablecoin minting information per minter. We needed to minimize the amount of data stored and have the lowest gas fees possible. There was also the issue of minters redeeming different amounts than they had minted. So, simply tracking each mint and forcing that exact XSD redemption amount was not user friendly.

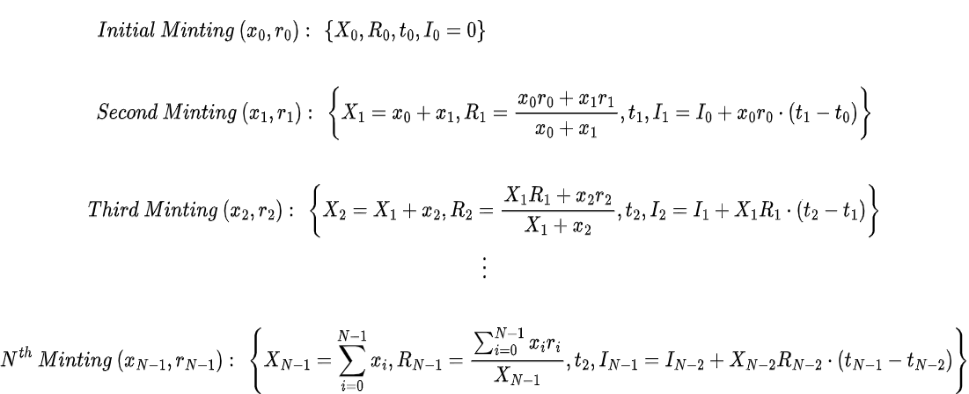

We developed a system of equations that most effectively stores this information. These equations store 4 variables for each minter:

- Date of Last Mint or Redemption

- Total Amount Minted

- Weighted Interest Rate

- Accrued Interest Earned up until the ‘Date of Last Mint or Redemption’

Since it is not necessary to calculate interest daily because minters will be in their stablecoin for long periods of time (due to the no liquidation of collateral design), your total interest earned is only calculated when you interact with the system to mint or redeem. The accrued balance after each mint or redemption is stored. With this design, you can redeem any amount of your minted balance.

This is facilitated by combining the various interest rates from the respective mintings of a given user into a running weighted average. Once a user mints a new batch of XSD, the prior amount of interest accrued is stored in the blockchain. Such a method significantly reduces the memory and computational load upon the smart contract.

If a user decides to redeem some proportion of their XSD, they receive the same proportion of their total accrued interest. Any remaining XSD then continues to accrue interest with the most recently updated weighted average.

Minting Sybil Attacks

Since we store the wallet address for each minter so that we can track the interest owed, this exposes the system to sybil attacks. A minter could create two wallets, minting with one and moving the XSD to the other wallet to redeem their collateral. The first wallet would continue to earn interest in the form of more BankX tokens inflating the currency without “locking up” the collateral (BankX and the native blockchain token). This defeats the economic principle we use to pay interest for minting the stablecoin.

To prevent this, only minters can redeem collateral from the collateral pool. Non-minters will need to use the BankX liquidity pool to trade in and out of the XSD stablecoin. This concept of putting the XSD liquidity pool in front of the collateral pool provides a mechanism to slow down a bank run since non-minters would need to sell XSD to minters before the collateral pool could be used. Solving for the ‘minting sybil attacks’ made the BankX system stronger.

Since XSD can be created without using the BankX minting function (putting collateral in the collateral pool to mint XSD), the system automatically burns these non-minted XSD stablecoins until there are none.

The following is how non-minted XSD is created:- Genesis Mint

- Rewards in XSD (when adding to L.P.’s or collateral pool)

- Minting ½ of the trading pair in XSD in the ETH/XSD liquidity pool

- NFT XSD Rewards

- Burn BankX for XSD when XSD is above the peg

- A percentage of XSD is burned in the XSD Liquidity Pool when it is sold

- Arbitrage – Burning XSD for BankX when XSD is below the peg

- BuyBack of excess collateral – All XSD is burned. Once non-minted XSD reaches 0, only BankX is accepted to buyback excess collateral.

Important Economic Levers & Overall Token Economic Health

In this section, we discuss the various economic levers and elements of the system that are inflationary and deflationary. To summarize, the following incentives are paid using these techniques:

- Mint BankX Tokens

- Mint the XSD Stablecoin

- More return for a longer vesting/lockup time

- More return when the system is in greater need in a certain area (EX. Liquidity Pools are in need of liquidity.)

Minting earns interest:

“Locking up” is always twice the inflation rate when the BankX token collateral percentage to mint XSD is 10% or greater. The minimum interest rate BankX pays is 5% to mint XSD so this would be net inflationary when the system needs less than 5% BankX tokens for collateral to mint XSD, neutral when there is 5% BankX token collateral needed.

The BankX system is designed to incentivize the behavior it needs to have a healthy system but to also maintain A.N.D. (Always Net Deflationary).

In the following order of importance, the BankX systems incentivizes:

- Adding ETH/BNB to Liquidity Pool #1: ETH/BNB vs. XSD:

This is inflationary in the BankX token supply.

- Adding ETH/BNB to Liquidity Pool #2: ETH/BNB vs. BankX:

Same as #1.

- Add Collateral and Buy Back Collateral to maintain the Stablecoin % Collateral:

- Collateral Deficit – inflationary to pay rewards to add collateral.

- Collateral Surplus – deflationary as the BankX tokens used to buy back the surplus collateral are burned.

- Token Lockup Rewards:

Hex has proven this is net deflationary to the system (3.69% inflation to pay for 9.8% lockup of the token supply). Our net deflation numbers may be different from this because BankX adjusts the Longer Pays Better bonus to help create a net deflationary BankX token supply.

IPOL (Integrated Protocol Owned Liquidity):

Adding to the Protocol Owned Liquidity discussion, BankX is the first to introduce the concept of an Integrated Protocol Owned Liquidity system. Because the BankX protocol owns the liquidity pools, it can do things to ensure sound economic policy over projects that “rent liquidity”. The IPOL system is the last line of defense to maintain an Always Net Deflationary (A.N.D.) token economy. The system does 2 things to get back to a deflationary environment when the system has identified the BankX token as “inflationary” (inflation is greater than the amount of tokens locked up):

- 10% of newly sold BankX tokens into the Liquidity Pool (ETH/BNB vs. BankX only) are burned by the system.

- If #1 doesn’t work, after period of time, 1% of the total BankX tokens in the Liquidity Pool are burned each week until the system reaches a net deflationary state.

Projects like SafeMoon “tax” token owners when they sell. BankX takes a different approach. Sellers of the BankX token capture the full value market price at the time they sell while the IPOL system burns tokens, if needed, to ensure the system remains net deflationary.

Furthermore, BankX does not charge transaction fees in our liquidity pools. Buyers and sellers of XSD and BankX are drawn to our liquidity pools due to no fees, concentrating liquidity in our decentralized liquidity pools. Because no fees are earned, there is no incentive for liquidity providers to add liquidity to pools that the BankX protocol doesn’t own. The only incentive for the market is to sell liquidity ensuring a 100% Protocol Owned Liquidity Pool structure.

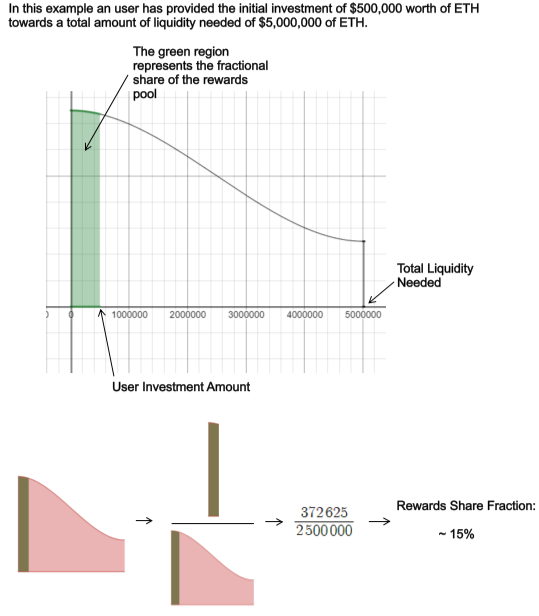

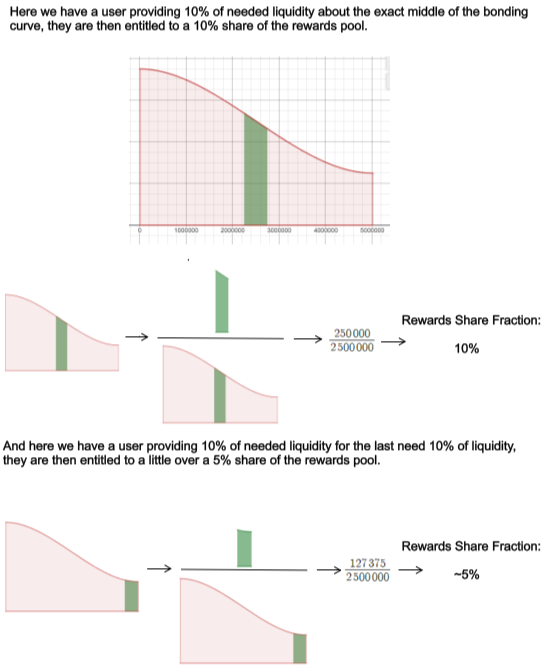

To incentivize selling liquidity, the protocol utilizes bonding curves that are designed to reward earlier investors proportionally more so than later investors. For example, suppose a given amount of liquidity is needed for a pool and the first investor provides 10% of the needed capitalization, that would entitle them to nearly 15% of the total rewards pool. The same amount invested towards the middle 10% of the needed liquidity yields a 10% share. whereas an investor providing the final 10% of needed liquidity would get 5% of the rewards pool.

This all very simply accomplished by using the variables:

E = Total Liquidity

b = Amount Invested on the bonding curve when a user invests

I = Total amount invested by the user

The bonding curve itself is given by:

And the fractional share of rewards the user is entitled to for a given investment I, is computed by dividing the area under the bonding curve over the region of investment, by the total area under the bonding curve. That number as a percentage is the relative amount of the Rewards Pool that the user will earn

Unique Value Proposition:

BankX is the first stablecoin that earns interest while you keep it in circulation. It is fully decentralized, trustless and does not involve USD (except as the unit of account). USD is not used as collateral and the stablecoin is pegged to the price of 1 gram of silver. The stablecoin, XSD, is meant to be the reserve cryptocurrency. We will build decentralized applications that drive the usage of the stablecoin. The BankX token can be locked up to earn more BankX. BankX is the first protocol to introduce the concept of the “Integrated Protocol Owned Liquidity” where sound monetary policy and A.N.D (Always Net Deflationary) is ensured within the protocol owned liquidity pool.